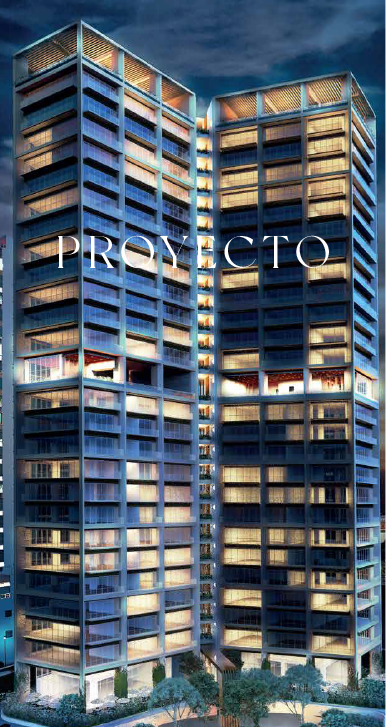

Legacy Tower nace con el objetivo de ser un producto inmobiliario de excelencia, cuidando minusciosamente cada detalle hasta crear un proyecto arquitectónico que trascienda en el tiempo y convertirse en un ícono de nuestra ciudad.

Lobby

Gym

Kids Club

Teen Club

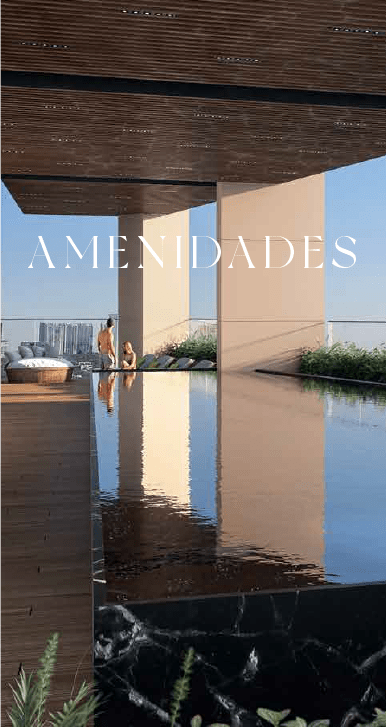

Roofgarden

Kids Ballroom

Ballroom

Lobby

Kids Club

Kids Ballroom

Gym

Teens club

Ball room

Roof garden